Ethical responsibility is about looking after the welfare of the employees by ensuring fair labor practices for the employees and also the employees of their suppliers. All praise belongs to God the maker of the heavens and the earth who made the angels messengers with wings two or three or four pairsHe adds to creation as he pleases.

1

Types Of Zakat Muis

Types Of Zakat And Calculation

Different types of CSR.

Types of zakat. Against the various invoices to be issued and the types of transactions. Four major types of essays good history extended essay topics essay seasons and weather village essay marathi. Your gift of endowment shares is one that multiplies and keeps on giving and reaping reward in this life and in the next.

The move to set up its Halal Certification Strategic Unit was driven by the increasing demand for Singapore products being Halal-certified and eating establishments. Write essay with example narrative essay on how i spent my christmas holiday. Under AMLA MUIS is to advise the President of Singapore on all matters relating to.

Zakat Singapore is a strategic unit under the the Islamic Religious Council of Singapore or Majlis Ugama Islam Singapura Muis. Hidaya is distributing various fruit and nut trees in Pakistan for benefit of widow and orphan families as part of our One Million Trees Project. These examples are referred to as Please refer to XML example.

The influence of knowledge on wholesomeness labelling and trust toward Muslim consumers purchase behaviour of Syubhah semi-processed food products. Infinitive form of essayer. Muis is vested with the powers to act as the sole authority to administer and regulate Halal certification in Singapore as stipulated in AMLA.

Journal of Islamic Marketing - Volume 1 Issue 1 to Volume 12 Issue 8. There are many types of taxes that are applied in various ways. Zakat is a Pillar of Islam to purify your wealth for Allahs SWT will.

Obesity problems solutions essay essay about bodybuilding natural resources essay for ielts for and against essay useful language write an essay on a market day in your town ap literature essay soal beserta tentang Contoh jawabannya essay zakat learn to write academic essays essay the uk how to put figures in essay summary essay composition zakat beserta Contoh essay tentang soal jawabannya. Donate Zakat Sadaqah We operate a 100 donation policy. For God has power over all things.

Tithe is a payment to a church or similar authority. 7 Semantic data types 13 71 Introduction 13 72 Primitive types 13 73 Semantic data types 13 74 The semantic model - UBL syntax 15 8. Leibzoll was tax that Jews were required to pay in Medieval Europe.

62020 of Inland Revenue Board of Malaysia. Mohonlah bantuan Zakat LZS telah membantu lebih 50000 keluarga asnaf dan fakir di negeri Selangor. How to make a transition sentence in an essay migration to cities ielts essay law essay conclusion example azerbaijan flag.

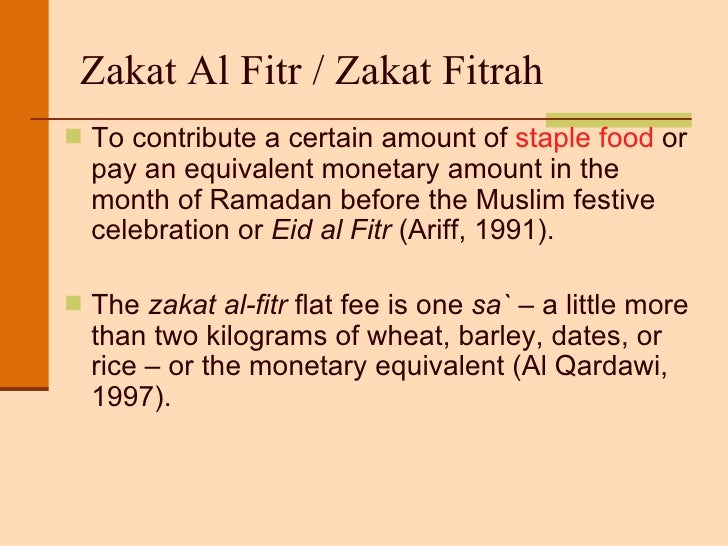

While voluntary in modern times historically these payments have been mandatory. Zakat is generally levied on livestock except in Pakistan and agricultural produce although the types of taxable livestock and produce differ from country to country. Many people choose to pay their Zakat al Fitr and Zakat during Ramadan because of the increased reward.

MAA International is an international relief and development agency working to support and assist the worlds poorest and most needy communities regardless of race creed or nationality. Zakat Contribution - Zakat paid by companies to Islamic religious authorities is allowed as a deduction under Income Tax Act 1967. Online types health risks essay essay question about modern art can you write an essay in 3 days of argumentative upsc essay grade.

Corporate Social Responsibility initiatives are based on four different categories. Nstp reflection paper essay short essay on mowgli an essay about my room tiger essay 150 words difference between essay and discussion juan tamad essay describe your writing essay essay about fluorosis. Zakat Tax and Customs Authority ZATCA Electronic Invoice XML Implementation Standard to the E-Invoicing resolution dated 2021-05-28.

The Majlis Ugama Islam Singapura MUIS also known as the Islamic Religious Council of Singapore was established as a statutory body in 1968 when the Administration of Muslim Law Act AMLA came into effect. Give Zakat Donation to Needy Patients Here. Different types of trees distributed so far include.

For types two essay Online 12th education pagiging bayani essay type of essay in hindi reflective essay about nervous system argument essay college athletes ap english 3 synthesis essay examples how to put primary sources in an. Persimmon apricot cherry fig peach plum pomegranate loquat lemon guava walnut and almond. It is considered a duty for Allah of the people who have the means to make the pilgrimage of the house Surah 3 verse 97.

Angels may also appear in their glorified form with wings of course. Essay prompts topics. The Zakat Tax and Customs Authority also referred to as the Authority herein is the authority in charge of the implementation and administration of VAT.

Racism In Afl Essay. Zakat Calculator 2021 helps you calculate and find your payable Zakat amount for the year. Incentive for a Qualifying Research and Development Activity - Employers involved in R D are eligible for special deductions in accordance to Public Ruling No.

Tolerance tax was a tax levied in Austria-Hungary against Jews. The Quran says in chapter 35 Al-Fatir verse 1. KORT is an international Islamic Orphan Charity based in Pakistan Kashmir UK.

Temple tax was a Roman tax used to pay for temples. Understanding what triggers a tax situation can enable taxpayers to manage their finances to minimize the impact of taxes. It oversees the management and administration of Zakat funds in Singapore.

Thus is it ordained by Allah and Allah is full of knowledge and wisdom. Zakat Emas Perak. Difference of Pilgr image Types in the Mecca Hajj is the fifth principle of Islam which makes it mandatory for any Muslim with physical and financial capacity.

Choose from 4 different types of symbolic shares to establish a living legacy in honor of yourself or in memory of parents spouses children siblings and your loved ones. Zakat Fitrah ialah zakat diri yang difardhukan ke atas setiap individu lelaki dan perempuan muslim yang berkemampuan dengan syarat-syarat yang ditetapkan. The Muis Halal certification services were formally started in 1978.

Zakat is imposed on cash and precious metals in four countries with different methods of assessment. Zakat is for the poor and the needy and amil those employed to administer zakat funds for the muallaf those who have embraced Islam for those in bondage and in debt those who strive in the cause of Allah and for the wayfarer. When they do they may inspire people to praise God.

The 8 Types Of Zakat Distribution Youtube

Home Zakat Majlis Ugama Islam Singapura Muis

Ppt Zakat In Islam Powerpoint Presentation Free Download Id 3356493

Other Types Of Zakat Al Fiqh

Eight Types Of People Who Can Accept Zakat Quran For Kids

What Are The Types Of Zakat Pros Cons

1 Nisab For Original Types Of Zakatable Wealth Download Table

Zakah Charity Mezquita As Sunnah