21 July 2021 New submission deadline for Form P B extended from 15 July to 31 Aug 2021. Penalty for not filing GSTR.

List Of Lhdn S Income Tax Relief For E Filing 2021 Ya 2020

不要选错form Explore Facebook

Tarikh Akhir E Filing 2021 Bila Mula Isi Tutup Buka

Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business in Malaysia is not that.

E filing due date 2021 malaysia. The due date for submission of Form BE for Year of Assessment 2020 is 30 April 2021. Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts. Correspondence address State IMPORTANT REMINDER submitted information via b 1 Due date to furnish this form.

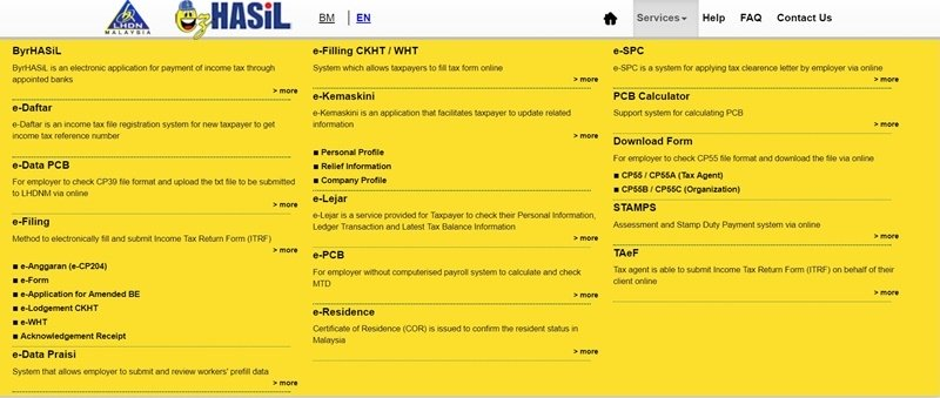

Pond Technologies Holdings Inc. For the FY 2020-21 AY 2021-22 the due date for Income Tax e Filing of all taxpayers extended to 31 December 2021. E-Filing For Income Tax Starts On 1 March 2021 LHDN Inland Revenue Board has recently released the Return Form RF Filing Programme For The Year 2021 on its website which listed all the file types due dates grace period and filing method for your references.

Additionally consider filing a tax extension and e-file your return by October 15 2022. The 7 percent requirement has been extended to a disposer that is a company not incorporated in Malaysia in effect 1 January 2020 and further extended to a disposer that is an executor of the estate of a deceased person who is not a citizen and not a. Penalty 10 of the tax due or Rs.

Same as the filing due date Same as the filing due date Same as the filing due date Same as the filing due date Yes subject to the appointment of a local representative by the tax uthorities. The due date for submission of Form LE3 for Year of Assessment 2022 Year of Assessment 2021 under the ITA 1967 is on 30042020. If a taxpayer furnished his Form e-BE for Year of Assessment 2020 on 16 May 2021.

Ranked at 24 th in 2018 World Banks Ease of Doing Business Malaysia is fast gaining traction as one of the favourite investment destinations to do business in Malaysia and building a business in Malaysia. E-file Borang 1 and 2. 182021 dated October 29 2021 regarding the extension of last date of filing of Cost Audit Report to the Board of Directors under Rule 65 of the Companies Cost Records and Audit Rules 2014.

Free ITIN application services available only at participating HR Block offices and applies only when completing an original federal tax return prior or current year. If you owe taxes you might be subject to late filing and late payment fees if you wait until after the deadline to e-file your return. If the due date for submission falls within the MCO period extension of time will be given until 31 May 2020 for the.

Payable quarterly with the first interest payment due. E-filing or online filing of tax returns via the Internet is available. On or before the due date for filing.

E 2-1-1 Commercial Unit Bukit Utama 1 Changkat Bukit Utama PJU 6 Bandar Utama 47800 Petaling Jaya Selangor Malaysia CONTACT DETAILS. The Options have a term of 5 years and vest as to one-third on the date. One-month extension for filing tax returns for 2021 23 August 2021 The Malaysian Inland Revenue Board on 19 August 2021 announced an additional one-month extension of time to file income tax returns for 2021.

Filing an extension automatically pushes back the tax filing deadline and protects you from possible penalties. North Macedonia Last reviewed 18 August 2021 The due date for the CIT return is the end of February or if filled electronically 15 March following the calendar year. 10000 whichever is higher.

Grace period is given until 15 May 2021 for the e-Filing of Form BE Form e-BE for Year of Assessment 2020. Category of Taxpayer Deadline for filing tax returns. In continuation to this Ministrys General Circular No152021 dated September 27 2021 in view of the disruption caused by the COVID-19 pandemic.

Yes None at this time but there are issuances to clarify the tax treatment. Please note that Borang 1 and the Affidavit are to be filed separately and separate filing fees must be paid and not as one document. 4 Your income tax refund will be done through Electronic Fund Transfer EFT to your bank account.

The official text is the English version of these tax forms. However currently the GST portal is aligned to charge a late fee only on returns GSTR-3B GSTR-4 GSTR-5 GSTR-5A GSTR-6 GSTR-8 GSTR-7 and GSTR-9 only. A Complete Guide to Start A Business in Malaysia 2021.

Announces Filing of 2021. Return Form RF Filing Programme For The Year 2021. 2 UNDER SUBSECTIO COMPLETE THE FOLLOWI Employers no.

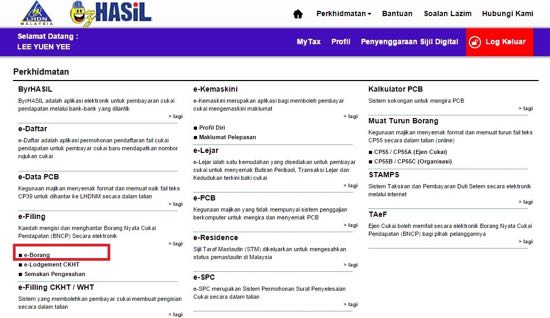

E-filing is encouraged by the Inland Revenue Board. 10000 whichever is higher High-value fraud cases also have jail term Penalty for helping. Any discrepancies or differences created in the translation are not binding and have no legal effect for compliance or enforcement purposes.

Further Borang 1 must be dated before e-filing the same the date must be the same as the date of the Affidavit verifying the Petition. The MCA issued General Circular No. For example if you owe 2500 and are three months late the late-filing penalty would be 375.

Return Form RF Filing Programme For The Year 2021 Amendment 12021 Return Form RF Filing Programme For The Year 2021 Amendment 22021. See IRSgov for details. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021. Penalty 100 of the tax due or Rs. 31 March 2021 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2021.

Yes Yes Yes with effect from 1 Jan 2020 Yes None at this time. The due date for the CIT return on distributed profit arising from FY 2009 to FY 2013 is the date of. Some content such as images videos Flash etc may not be accurately translated due to the limitations of the translation software.

Late-filing penalties can mount up at a rate of 5 of the amount due with your return for each month that youre late. The late fees will be calculated for three days and it should be deposited in cash. The International Civil Service Commission ICSC is aware of various schemes being circulated via e-mails ie.

On or before the due date for filing. 60 3 2787 9168. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

GST return in GSTR-3B is filed on 23rd January 2021 3 days after the prescribed due date ie 20th January 2021. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Penalty for committing a fraud.

Income Tax Malaysia 2021 Deadline

Extension Of Time Faq From Lhdn Dated 2 June 2021 In Relation To Mco 3 0

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Inland Revenue Board Of Malaysia

Extension Of Deadline 2 Months For Filing Malaysia Income Tax 2020

Business Income Tax Malaysia Deadlines For 2021

Business Income Tax Malaysia Deadlines For 2021

Malaysia Personal Income Tax Guide 2020 Ya 2019